A Case Study in Speculative Demand Markets Crumbling

Here's what's going on with ViacomCBS, Tencent, and GSX.

Over the last week, a handful of stocks have been getting just absolutely crushed, and this has caused quite a bit of uproar on Wall Street and beyond. GSX Techedu (GSX) is currently below $34 per share despite being over $80 per share five days ago. Similarly, ViacomCBS (VIAC) was over $90 per share on March 23; it now trades at $45 per share. Tencent Music Entertainment Group (TME) has dropped around 33% in the same timeframe to around $20 per share.

So what happened and why? I think the key to understanding this situation is something that I have written about previously in my first article on GameStop (GME) and my article on stock bubbles. The pricing of these stocks was driven by speculative demand. I want to stress that speculative demand is different from value demand or other types of demand. Speculative demand happens when people buy a certain stock only because they think the price will go up. They intend to “flip” the stock: Buy, hold while it appreciates, then sell for a profit. This speculation is not related to any underlying information about the stock itself. Value demand happens when people buy a stock because it is below its intrinsic value. They buy because of the fundamentals and the value they are getting, not because of anticipated future stock price movement, per se.

Now, before people start to complain, I realize that the distinction between the types of demand is artificial and not straightforward at all (and that my explanation was rather poor). Who is to say that some people buying value are not speculating? In reality, there is no difference. A buyer is a buyer. I am just attempting, in a very muddled way, to give names to the general attitudes of buyers that might come into a market. Despite the fact that I have set up what seems like an arbitrary distinction above that has no meaning, there really is an actual phenomenon here that is playing out, which the names “speculative demand” and “value demand” do describe. The clearest way to illustrate this is through the price-to-book ratio.

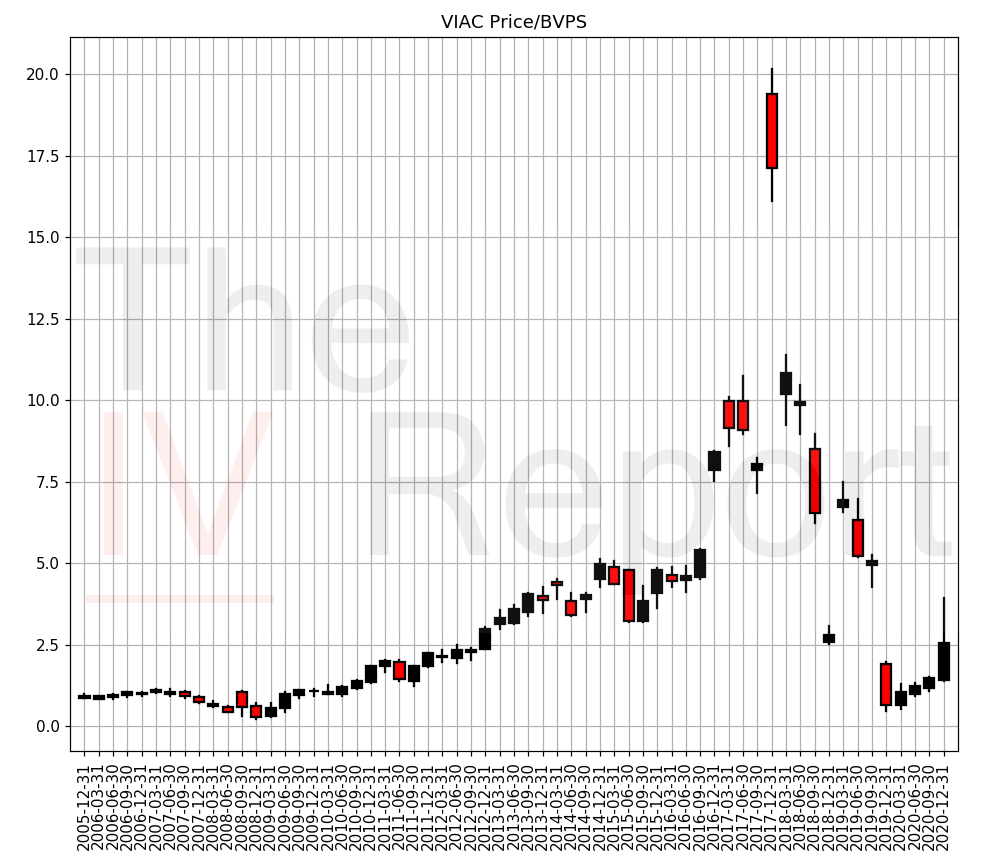

Let’s take ViacomCBS first. One of the reasons for its selloff was that the company is planning to sell new shares. The actual reason for the price drop is immaterial for our analysis, however. The real danger here is that the stock was very overvalued before it started to drop and is still over its intrinsic value now. To prove this, I will not actually calculate the IV; instead I will defer to the PB ratio. The PB ratio for ViacomCBS is shown in Figure 1 below.

ViacomCBS was trading at around 4 times its book value before it dropped. It was certainly above its intrinisic value, and it almost certainly still is overvalued at a PB of 2.5 (it is not a solid, value accumulating company). What does this mean? The drop could continue if speculative demand continues to pull out, as it was the only thing keeping the price up. There is no reason why the price should stabilize at a PB of 2.5, and it could continue to fall all the way down past the intrinsic value. Value investors will gladly eat up the shares at that point. This exact situation is the danger of investing in a company whose share price is completely detached from its intrinsic value because of speculative demand: One day the speculation could just stop, leaving investors holding the bag. I am a value investor for exactly this reason.

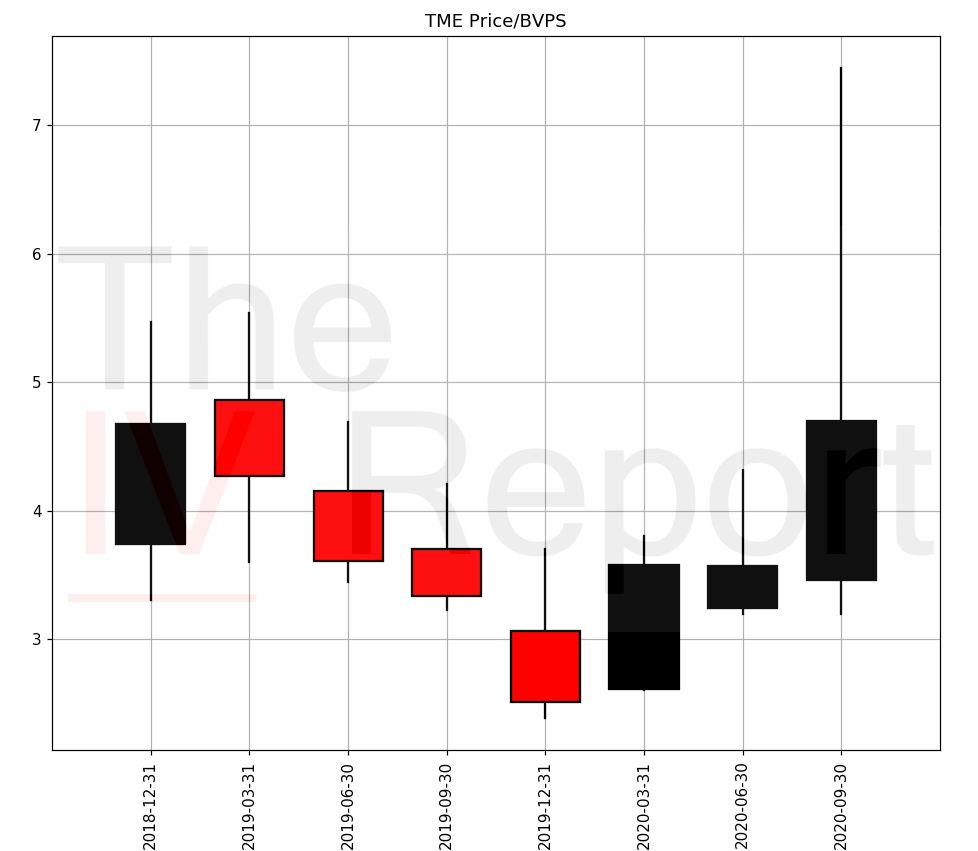

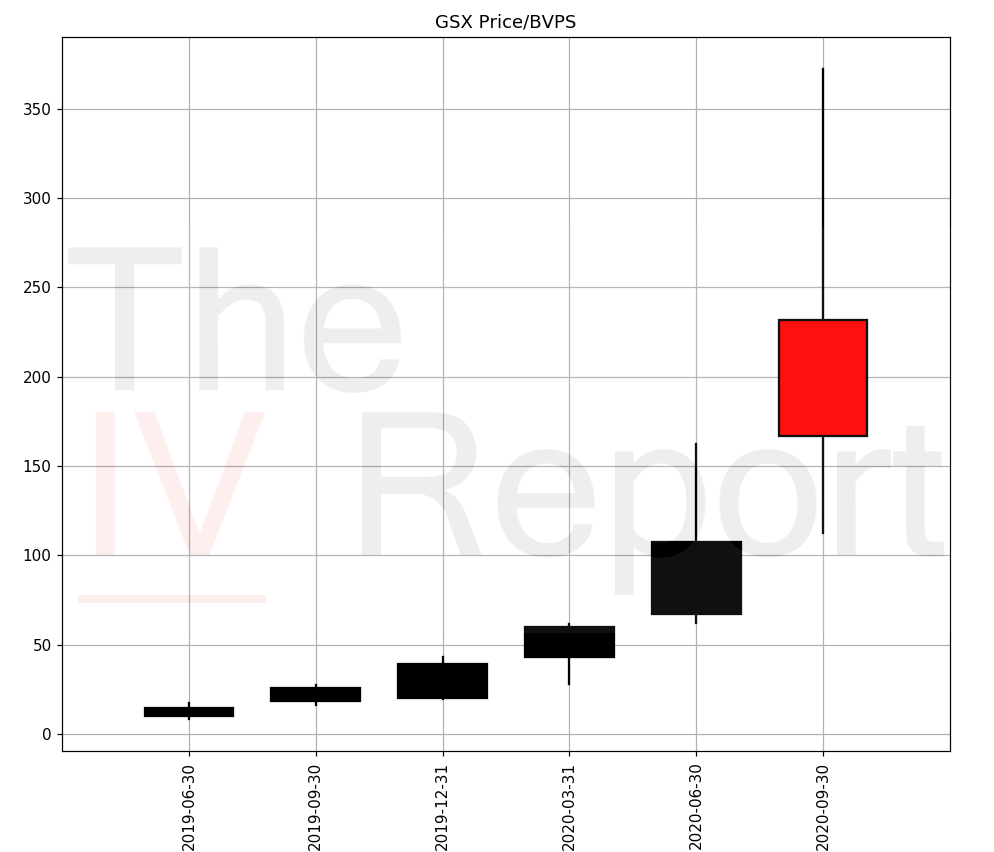

If ViacomCBS was not bad enough for you, take a look at the PB plots for Tencent and GSX in Figures 2 and 3 below (ignore the fact that the last date is September 2020 - this is an artifact of the data provider I use).

The peaks in PB for Tencent and GSX were around 7.5 and 370, respectively. GSX is one of the most grossly overvalued companies I have ever seen. Yet again, in these cases, there is no fundamental reason for each stock’s fall to stop at these levels. Why is a PB of 175 for GSX more appropriate than a PB of 50? Both are absurd. I will re-iterate: There is no fundamental reason that these stocks will stop dropping until they hit their intrinsic values. The scenario we are seeing play out in these three companies is the exact reason I only put my money in value plays. Of course, the market will do what it wants. These stock could continue to drop, or they could recover and go higher than ever before. That is just how this wild game works.

That’s all for today! If you enjoyed this article, I would be grateful if you could share it, or join my mailing list to get my articles in your inbox (for free), or subscribe (now for the blowout deal of only $5 a month!!!). I have a 30 day free trial to my paid subscription. With it, you will be able to see my portfolio discussion articles, where I talk about the stocks I own and my analysis of them using great graphs like those in this article. I will have part 3 of this series out soon! Also, check out my newly-started YouTube channel. I will be dropping exclusive content on there sporadically, so subscribe so you don’t miss anything. See you next time!